Ah yes, game industry consolidation is great isn't it. What could possibly go wrong when one company acquires a ton of others and then screws up?

Embracer Group are known for going on acquiring sprees and currently own the likes of THQ Nordic, Coffee Stain, Gearbox, Plaion (formerly Koch Media), Saber Group and all the studios they control like Flying Wild Hog, Warhorse Studios, 3D Realms, New World Interactive, Tripwire Interactive, Aspyr Media, Beamdog and the list just goes on and on and on. Their own website lists 850 IPs either owned or controlled.

Well, they're having a few problems. They announced in a previous revenue report that a "major strategic partnership that has been negotiated for seven months will not materialize", this deal included "USD 2 billion in contracted development revenue over a period of six years" - so it was a pretty huge hit to their plans.

Now less than a month later they're announcing a "comprehensive restructuring program", that will see amongst other things the closing of various currently undisclosed studios and terminating various projects. In an open letter the CEO Lars Wingefors mentioned their plan will "transform us from our current heavy-investment-mode to a highly cash-flow generative business this year".

Frankly, this kind of sounds like their buyouts were leveraged from the start

Well yeah, that's how, was far as I know, almost every industry works... On credit.

When I worked in construction, our company owner would joke "The entire industry would freeze if any one actually tried to collect their bills!!"

Even small business do the same. A deli owner friend of mine remarked how he didn't turn a profit for his first 5 years and how that was the average for his industry/region. That's 5 years with everything on credit and even if he did make some profit, the debt is still there.

I'm some cases, paying off debts is considered a waste of money as you get higher yields investing that money vs the savings from paying early (or at all), especially in during our past decade where interest rates were low.

Of course, that can bite people and companies when expected investments fall apart, as it seems to have done here.

Lovely capitalism.

If other people start restaurants and use debt to help finance their operations, and then I take out debt to buy some of those restaurants (along with the debt the restaurants already had), that means I'm stacking new debt on top of the old debt, but not adding any new productive activity.

I think there's a third variant: Companies aiming for world domination, that are not even trying to make profits. Uber is (was?) expanding and expanding while making billions of loss. The restaurant boss in contrast wants to make profit from the beginning, it's just not something that happens from day one. And they probably wouldn't open another restaurant before the first one works well.

"transform us from our current heavy-investment-mode to a highly cash-flow generative business this year"

Gotta love that corporate doublespeak. Which new gibberish will they invent next?

Not so sure exactly what it is here that you think sounds doublespeak? This just means that they have halted their expansion and will now concentrate on generating income instead.

They could have thought that the lack of funding, or not getting a deal, could happen and start being a highly cash-flow before that to prevent this. They could also give the middle finger to investors and say they won't be returning their money any time soon, and keep the studios and their workers. The high execs could also freeze their super high salaries for an X amount of time to palliate the problem.

But no, they directly prefer cutting costs to the expense of workers.

To me, the doublespeak is undermining the effect of these cuts on those affected, like if it was the most normal thing in the world, and the fact that they lost $2bn investment, by trying to positively say that it will allow them to be highly cash-flow generative.

Frankly, this kind of sounds like their buyouts were leveraged from the start

Well yeah, that's how, was far as I know, almost every industry works... On credit.

When I worked in construction, our company owner would joke "The entire industry would freeze if any one actually tried to collect their bills!!"

Even small business do the same. A deli owner friend of mine remarked how he didn't turn a profit for his first 5 years and how that was the average for his industry/region. That's 5 years with everything on credit and even if he did make some profit, the debt is still there.

I'm some cases, paying off debts is considered a waste of money as you get higher yields investing that money vs the savings from paying early (or at all), especially in during our past decade where interest rates were low.

Of course, that can bite people and companies when expected investments fall apart, as it seems to have done here.

Lovely capitalism.

People being irresponsible with finances (and, yes, taking out huge loans that you can't easily repay is irresponsible) is not a feature of capitalism.

Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.Frankly, this kind of sounds like their buyouts were leveraged from the start

Well yeah, that's how, was far as I know, almost every industry works... On credit.

When I worked in construction, our company owner would joke "The entire industry would freeze if any one actually tried to collect their bills!!"

Even small business do the same. A deli owner friend of mine remarked how he didn't turn a profit for his first 5 years and how that was the average for his industry/region. That's 5 years with everything on credit and even if he did make some profit, the debt is still there.

I'm some cases, paying off debts is considered a waste of money as you get higher yields investing that money vs the savings from paying early (or at all), especially in during our past decade where interest rates were low.

Of course, that can bite people and companies when expected investments fall apart, as it seems to have done here.

Lovely capitalism.

People being irresponsible with finances (and, yes, taking out huge loans that you can't easily repay is irresponsible) is not a feature of capitalism.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

"transform us from our current heavy-investment-mode to a highly cash-flow generative business this year"

Gotta love that corporate doublespeak. Which new gibberish will they invent next?

Not so sure exactly what it is here that you think sounds doublespeak? This just means that they have halted their expansion and will now concentrate on generating income instead.

They could have thought that the lack of funding, or not getting a deal, could happen and start being a highly cash-flow before that to prevent this. They could also give the middle finger to investors and say they won't be returning their money any time soon, and keep the studios and their workers. The high execs could also freeze their super high salaries for an X amount of time to palliate the problem.

But no, they directly prefer cutting costs to the expense of workers.

To me, the doublespeak is undermining the effect of these cuts on those affected, like if it was the most normal thing in the world, and the fact that they lost $2bn investment, by trying to positively say that it will allow them to be highly cash-flow generative.

There is no way that a public company can give the finger to investors. Remember that the investors, aka the share holders, are the actual owners of the company, the CEO and other execs are only running the company per the will of the shareholders.

Still don't get how any of that turns the quote into doublespeak. It's quite clear what they mean and it also exactly describes the situation and what they are going to do.

The notion that a corporation’s primary purpose is to look after its shareholders is widely believed and taught, but is in fact a myth with no basis in corporate law. The corporation is a separate legal entity. Because ownership of assets and liabilities are attributed to this entity, corporations are not “owned” by shareholders.

Instead, shareholders have limited legal rights, which do not include the right to directly control directors’ or managers’ behaviour. Indeed, shareholders have no special claim on a corporation’s economic returns. Their right to dividends is the same as a waiter’s right to tips: an expectation that is unlikely to be enforceable in court.

There is no way that a public company can give the finger to investors. Remember that the investors, aka the share holders, are the actual owners of the company, the CEO and other execs are only running the company per the will of the shareholders

So, not quite true. Companies decide to allign with them.

People being irresponsible with finances (and, yes, taking out huge loans that you can't easily repay is irresponsible) is not a feature of capitalism.

Capitalism thrives off irresponsible people. It's no a coincidence that day to day finances are not taught in school from very early age.

Someone's mysery is another's profit. Yeah, it is a feature.

Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.That's like saying that traffic accidents are a "feature" of automobiles.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

Last edited by Mountain Man on 15 Jun 2023 at 12:56 pm UTC

They are. Introducing the automobile is introducing the traffic accident.Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.That's like saying that traffic accidents are a "feature" of automobiles.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

You apparently define the term "feature" so broadly that literally anything can be considered a feature.They are. Introducing the automobile is introducing the traffic accident.Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.That's like saying that traffic accidents are a "feature" of automobiles.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

You apparently define the term "feature" so broadly that literally anything can be considered a feature.They are. Introducing the automobile is introducing the traffic accident.Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.That's like saying that traffic accidents are a "feature" of automobiles.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

According to my understanding, "feature" can be understood in two ways: as a property/trait of something, or in the dichotomy bug vs. feature, as an intended trait.

In all of our history, car traffic has come with accidents. Of course, this is not intended.

Last edited by Eike on 15 Jun 2023 at 4:18 pm UTC

I already went over the definition issue in my first comment about that. Personally, I usually read someone's whole post before I start arguing with it, especially if it's just three lines long.You apparently define the term "feature" so broadly that literally anything can be considered a feature.They are. Introducing the automobile is introducing the traffic accident.Depends what you mean. In the sense that it's a bug rather than a feature, sure. Or, in the sense that it's not "intended", OK.That's like saying that traffic accidents are a "feature" of automobiles.

In the sense that a "feature of X" is something that inevitably goes with it . . . yeah, it's a feature of capitalism.

This destroys competition very effectively. I'm smelling something bad here. Who'll get benefit here? Other bigger games studios. I wouldn't be surprised that this was meant to be from the beginning....Doubt it. I mean, which is worse for competition, Embracer Group having to stop its takeovers and axe some studios now, or Embracer Group keeping on for a few more years of grabbing every indie in sight? And it may be good for some other big studios if Embracer Group falters (maybe--or maybe they're fine with fewer indies), but how do the top Embracer Group people make any money from that? Maybe someone like MS persuaded Embracer's backer to back out, but that's not a "planned from the beginning" thing.

Last edited by Purple Library Guy on 15 Jun 2023 at 5:43 pm UTC

From the article [It’s a myth that companies must put shareholders first](https://theconversation.com/its-a-myth-that-companies-must-put-shareholders-first-coronavirus-is-a-chance-to-make-it-stop-129104):

The notion that a corporation’s primary purpose is to look after its shareholders is widely believed and taught, but is in fact a myth with no basis in corporate law. The corporation is a separate legal entity. Because ownership of assets and liabilities are attributed to this entity, corporations are not “owned” by shareholders.

Instead, shareholders have limited legal rights, which do not include the right to directly control directors’ or managers’ behaviour. Indeed, shareholders have no special claim on a corporation’s economic returns. Their right to dividends is the same as a waiter’s right to tips: an expectation that is unlikely to be enforceable in court.

There is no way that a public company can give the finger to investors. Remember that the investors, aka the share holders, are the actual owners of the company, the CEO and other execs are only running the company per the will of the shareholders

So, not quite true. Companies decide to allign with them.

That article is playing with words to convey a completely different picture than it really tells and your conclusion of it is incorrect. Yes a corporation is legally a separate entity from it's shares so the article is correct in that aspect, but the shares control all the assets so without the shareholders all you have is that legal entity of a corporation (aka you no longer have any of its products, none of its income, none of its cash, none of its assets). Basically all you have is a bunch of employees but no assets and no income.

As a shareholder you own shares, each share comes with votes (unless you happen to buy very special shares like the Alphabet ones that comes without votes which is mostly a US thing). At each shareholders meeting you use those votes to vote on various topics and with enough votes you can also put forward items to discuss and if you get enough other votes on that item then the company is obliged to comply. Most importantly however is that you vote on who constitutes the board, once the board is voted in they in turn decide on who they want to have as the CEO to carry out the boards directions as per the wished of the share holders that just voted them in.

So yes legally you the CEO can say screw the share holders and do whatever you like but at the next annual meeting you will be discharged with liability.

But this is not to say that the primary purpose of the company is to look after it's shareholders, see this is another notion where the article is correct but written in a way to convey a different context than what that sentence really means. The primary goals are written into the companies articles of association and is something that you as a potential investor have to look at before making an investment to make sure exactly what rights you might have or not have as a shareholder, however those articles can be changed by way of voting if you gather enough votes to make it a topic for the general meeting.

I sit on the board on some companies and are also a share holder in the very company that employs me and have exercised my rights as a share holder on occasion.

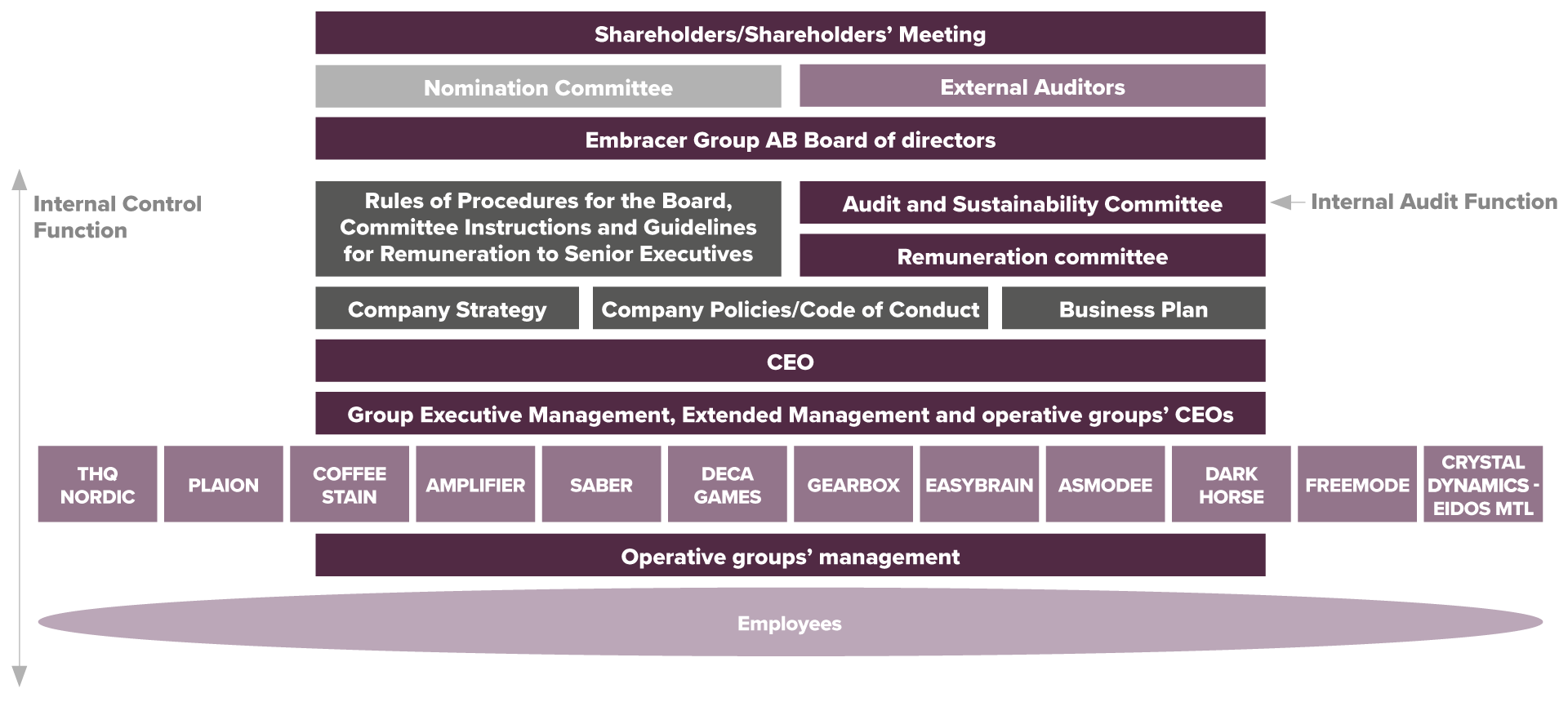

For Embracer in particular you can see the level of governance in this chart where you can see that all the power originates from the share holders:

They also clarify how the CEO is selected and what his or her responsibilitis are:

The CEO of Embracer Group is appointed by the Board of Directors to handle the Group’s day-to-day management and to lead the Group Executive Management Team, which also includes the Group CFO/Deputy CEO and the Chief of Staff, Legal & Governance.

And the role and powers of the board:

The Board of Directors is the highest decision-making body after the shareholders’ meeting and is ultimately responsible for Embracer Group’s organization, administration, long-term development and strategy. In accordance with the Swedish Companies Act this means that the Board is responsible for establishing targets and strategies, ensuring that procedures and systems are in place for the evaluation of set targets, continuously evaluating Embracer Group’s financial position and performance, and evaluating the executive management. The Board is also responsible for ensuring that the annual accounts and interim reports are prepared on time. The Board of Directors shall further ensure that the Company complies with applicable laws and regulations, Nasdaq Stockholm Rulebook for Issuers, the Swedish Corporate Governance Code, the Company’s articles of association and the rule of procedures for the Board.

The Board of Directors of the Company is responsible for Embracer Group’s organization and the management of its business worldwide and is obliged to follow directives provided by the shareholders meeting. The Board of Directors may appoint committees with specific areas of responsibility and furthermore authorize such committees to decide on specific matters in accordance with instructions established by the Board of Directors. Currently, the Board of Directors has established the Audit and Sustainability Committee and the Remuneration Committee.

In short your article is lying by omission and presents half truths using IMHO weasel words.

Makes me very sad if some of them where to close... :(

How to set, change and reset your SteamOS / Steam Deck desktop sudo password

How to set, change and reset your SteamOS / Steam Deck desktop sudo password How to set up Decky Loader on Steam Deck / SteamOS for easy plugins

How to set up Decky Loader on Steam Deck / SteamOS for easy plugins

See more from me